5 Reasons why a QP might not be a good account to have in retirement

Many financial advisors encourage their saver clients to contribute to their company’s qualified plan, at least enough to receive the ...

Read post →

Certain Uncertainties Can Erode Your Client’s Sense of Confidence

The uncertainties your clients face in retirement can erode their sense of confidence. Indeed, according to the 2017 Retirement Confidence ...

Read post →

Retirement Can Mean Different Things for People

Retirement can have many different meanings. For some, it will be a time to travel and spend time with family ...

Read post →

Needs vs Wants: People Move in the Direction of their Wants

Life insurance has historically been sold by the life insurance carriers as a “need” product. They start by offering a ...

Read post →

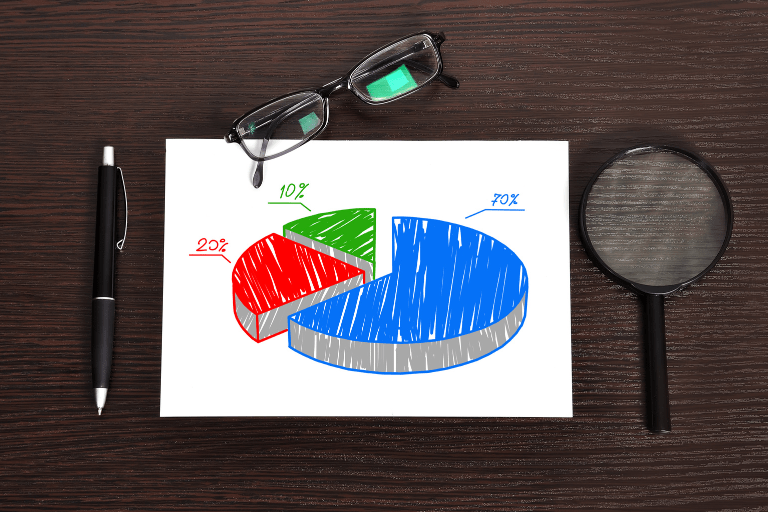

Asset Allocation is a Critical Building Block when Creating a Portfolio

If you live in or have visited a big city, you’ve probably run into street vendors—people who sell everything from ...

Read post →

How much do you know about one of the most important tools you have to help protect you and your family’s financial future?

Life insurance is a key risk management tool that can help you pursue your financial dreams and help protect the ...

Read post →

Explaining Term & Permanent Life Insurance to Your Clients and Prospects

According to industry experts, most people don’t have enough life insurance; and, more than half of consumers said their household ...

Read post →

The Other Sure Thing … It’s Never Too Early to Plan

The Other Sure Thing We’ve all heard the saying the only sure things in life is death and taxes. And ...

Read post →